In a groundbreaking legal case, the Kenyan High Court provided essential support to the Capital Markets Authority (CMA) in its regulatory mandate concerning initial coin offerings (ICOs) and crypto assets. The case of Wiseman Talent Ventures v Capital Markets Authority [2019] eKLR, often referred to as the “Kenicoin Case,” marked a significant turning point in the oversight of crypto assets within Kenya.

Justice M.W. Muigai delivered a judgment that reinforced the CMA’s regulatory powers in the crypto space.

The Howey Test and the Classification of Crypto Assets

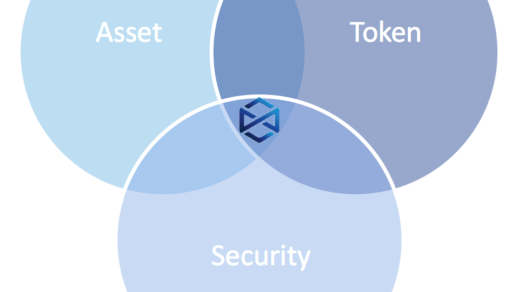

Central to the Kenicoin Case was the question of whether crypto assets could be classified as securities. The Howey Test, established in the well-known American case of Securities Exchange Commission (SEC) vs. W.J. Howey Co. (1946), played a critical role. This test revolves around four key elements:

- Investment of Money

- Expectation of Profits

- Common Enterprise

- Profits Derived from the Efforts of a Promoter or Third Party

If an investment meets these criteria, it qualifies as a security, subject to regulatory oversight.

The Plaintiff’s Activities and CMA’s Caution

The Plaintiff, acting as a sole proprietor, was involved in the sale of Kenicoins as investments in exchange for public funds, all without regulatory oversight. The CMA issued a strongly worded statement, cautioning the public against participating in Kenicoin’s ICO or trading in Kenicoin. The CMA’s argument rested on the assertion that crypto assets, including Kenicoin, met the definition of securities under the Howey Test.

Kenicoin, on the other hand, challenged the CMA’s authority in the context of crypto assets and claimed that the CMA’s regulatory actions constituted an abuse of power. The absence of specific laws governing digital currencies, exchanges, and related activities in Kenya was a central point of contention.

The Court’s Decision

In a pivotal judgment dated 27th September, 2019, the High Court ruled in favor of consumer protection and the regulatory authority of the CMA. The Court emphasized that, despite the unregulated nature of crypto assets, the balance of convenience tilted in favor of investor protection. It acknowledged the potential fiscal danger faced by investors due to the absence of regulations.

The Court asserted that the Howey Test provided the framework to determine the classification of Kenicoin as a security. Any crypto asset that satisfies the Howey Test’s criteria falls within the jurisdiction of the CMA, responsible for regulating capital markets and securities.

Justice M.W. Muigai highlighted the need for the investing public to be safeguarded while awaiting the establishment of an appropriate legal framework to regulate ICOs in Kenya. Pending legislative processes, the Court permitted the CMA to proceed with investigations and inquiries into Kenicoin’s operations.

Judge Mwangi’s ruling emphasized that Wiseman Talent Ventures had failed to establish a prima facie case, meaning that the damage, injury, or loss caused by CMA’s temporary injunction against the firm could not be adequately compensated by damages.

Conclusion

The Kenicoin Case represents a pivotal moment in Kenya’s evolving regulatory framework for crypto assets. The High Court’s decision solidified the CMA’s authority in overseeing ICOs and crypto asset exchanges, prioritizing the protection of investors and consumers.

As the regulatory landscape continues to evolve, this case serves as a foundational precedent for responsible crypto asset oversight and the development of the crypto industry in Kenya. It is a testament to the judiciary’s role in ensuring the security and stability of the crypto space.