The Nairobi International Financial Center (NIFC), a flagship initiative within the framework of Kenya’s Vision 2030, holds the promise of transforming Kenya into a regional financial hub, bolstering its global competitiveness and fostering sustainable economic development. Established in 2021, the NIFC has emerged as a beacon of hope, beckoning responsible and ambitious businesses to Nairobi while striving to optimize the operational framework for financial services and transactions, thereby attracting an array of capital pools and driving innovation. One of the areas of keen interest in this burgeoning financial landscape is the role of crypto assets.

The NIFC Vision

The NIFC’s vision is clear: to create a predictable and efficient business environment that facilitates financial services and transactions. By establishing a regulatory framework that fosters innovation, the center aims to become a globally competitive financial services hub. Its mission dovetails with Kenya’s broader national development blueprint, Vision 2030, which seeks to transform the country into a middle-income nation and a regional financial hub.

Crypto Assets and Capital Markets

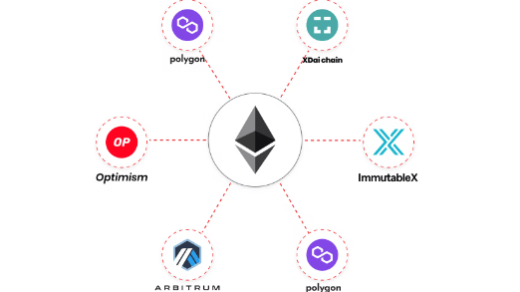

Crypto assets, like Bitcoin and Ethereum, as well as blockchain technology, have gained immense popularity and recognition in recent years. Their potential to disrupt traditional financial systems and facilitate efficient, borderless transactions is undeniable. This presents an exciting opportunity for the NIFC in its quest to deepen capital markets.

Attracting Investment:

Crypto assets have garnered the attention of both institutional and retail investors worldwide. By incorporating crypto assets into the NIFC ecosystem, the center can attract a new class of investors looking to diversify their portfolios. These investors may include crypto assets enthusiasts, high-net-worth individuals, and investment funds that focus on digital assets. As a result, the NIFC can stimulate responsible investments, inject liquidity into the market, and boost economic growth.

Fostering Innovation:

Blockchain technology, which underpins crypto assets, has vast applications beyond cryptocurrencies. It can revolutionize industries, streamline processes, and enhance transparency. By supporting fintech and blockchain companies within its jurisdiction, the NIFC can become a hub for financial innovation. These companies can create solutions that deepen capital markets by making financial processes more efficient and accessible.

Encouraging Financial Institutions:

As the adoption of crypto assets and blockchain technology grows, traditional financial institutions are exploring ways to integrate these technologies into their operations. The NIFC can leverage this trend to attract financial institutions that wish to establish a presence within a regulatory framework conducive to crypto assets. This will not only enhance the center’s reputation as a forward-thinking financial hub but also bolster the presence of established financial players in Kenya.

Strengthening Regional Competitiveness:

By embracing crypto assets, the NIFC can differentiate itself within the region. It can become a pioneer in Africa, setting an example for other countries and financial centers. This leadership can attract businesses and investors looking for stability and growth potential in the crypto space while contributing to the transformation of Nairobi into a gateway for African opportunities.

Conclusion

The Nairobi International Financial Center’s mission to deepen local and regional capital markets and establish Nairobi as a gateway to Africa’s burgeoning opportunities aligns perfectly with the potential of crypto assets. By tapping into the crypto revolution, the NIFC can unlock financial potential, attract a diverse set of investors, foster innovation, encourage traditional financial institutions, and strengthen its regional competitiveness.

As the financial world continues to evolve, embracing crypto assets is not merely an option but a strategic imperative for institutions like the NIFC that seek to remain at the forefront of the financial industry. By doing so, the NIFC can catalyze Kenya’s journey toward economic prosperity, elevate its status in the global financial arena, and serve as a catalyst for sustainable development in the region.