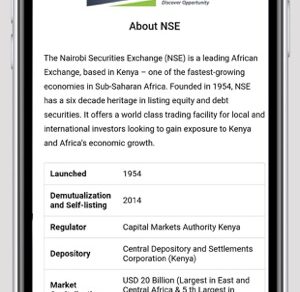

Investing in the Nairobi Securities Exchange (NSE) offers a multitude of opportunities for individuals looking to grow their wealth through the acquisition of shares and bonds.

The flexibility in the amount an investor can buy, coupled with the availability of various market boards, provides a diversified landscape catering to investors of different financial capacities.

Flexibility for Investors:

One of the notable features of the NSE is the flexibility it provides to investors regarding the amount they can buy. Investors have the freedom to purchase as little or as much as they can afford. This inclusivity ensures that individuals with varying financial capacities can participate in the market, fostering a diverse and dynamic investment community.

Group Investments:

For those looking to invest smaller amounts, an intriguing option exists in the form of group investments. Money managers in the market have created avenues for small investors to pool their resources together. This pooling of funds allows individuals to contribute smaller amounts collectively, creating a shared investment that is managed by a professional money manager.

Minimum Number of Shares:

In the primary market boards, shares are typically bundled in lots of 100 shares and above. This standardization streamlines the trading process and provides clarity for investors. Additionally, for those interested in quantities fewer than 100 shares, there is the option of the odd lots board.

Minimum Number of Bonds:

Bonds, a significant component of the NSE, are sold in minimum bundles of KShs. 50,000.00. This minimum requirement ensures that bonds remain an avenue for serious investors. Small investors, however, have the opportunity to participate by pooling their resources together, facilitated by money managers who navigate the bond market on their behalf.

Understanding the minimum purchase quantities for shares and bonds on the NSE empowers investors to plan their investment strategies effectively. Whether an individual investor looking to buy a specific quantity of shares or a group of small investors pooling resources for a bond investment, the NSE accommodates a wide range of financial scenarios, making it an accessible and inclusive platform for wealth creation.