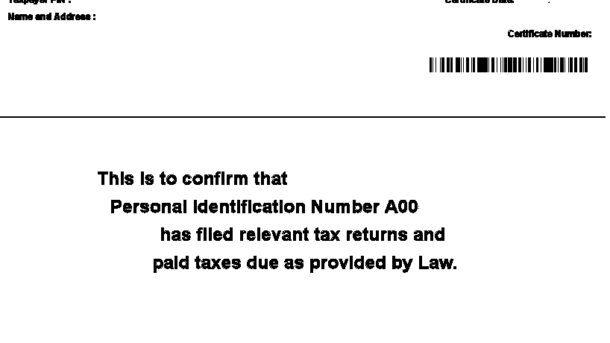

In the realm of taxation, the Tax Compliance Certificate (TCC) stands as a significant testament to an individual’s or business’s commitment to fulfilling their tax obligations. Issued by the Kenya Revenue Authority (KRA), the TCC serves as official proof that all necessary taxes have been filed and paid.

This article aims to unravel the importance, application process, and validity of the Tax Compliance Certificate.

Understanding the Tax Compliance Certificate

A Tax Compliance Certificate is a formal document provided by the KRA, affirming that the holder has met their tax responsibilities by filing and settling all due taxes. This certificate is a crucial requirement in various situations, ensuring transparency and accountability in financial matters.

When is a Tax Compliance Certificate Required?

The necessity for a Tax Compliance Certificate arises in several scenarios, including:

- Job Applications: While the TCC is not mandatory during the initial stages of job applications, it becomes a requirement upon the job offer.

- Government Tenders: Individuals or businesses bidding for government tenders must present a valid Tax Compliance Certificate.

- Work Permit Renewal: Expatriates seeking to renew their work permits must furnish a Tax Compliance Certificate.

- Clearing and Forwarding Agents License: Individuals in the logistics and shipping industry applying for or renewing a license must provide a Tax Compliance Certificate.

- Liquor Store License: Those interested in operating a liquor store need a Tax Compliance Certificate as part of the licensing process.

- Confirmation of Compliance Status: Individuals or businesses may request a TCC to confirm their compliance with tax obligations.

Tax Compliance Validity

A Tax Compliance Certificate is typically valid for twelve months from the date of issuance. This duration emphasizes the importance of regularly updating and maintaining tax compliance.

Application Process

Applying for a Tax Compliance Certificate has been streamlined through the iTax platform, KRA’s online tax system. The application process involves:

- Filing Tax Returns: Ensuring that all applicable tax returns are filed on or before the due date.

- Timely Tax Payments: Making sure that tax payments are settled on or before the stipulated due dates.

- Clearance of Outstanding Tax Debt: Resolving any outstanding tax debt is a prerequisite for obtaining a Tax Compliance Certificate.

- iTAX Platform: Initiate the application through the iTax platform, where the certificate is subsequently sent to the applicant’s email address.

Checking TCC Validity

To enhance convenience, individuals can now check the validity of their Tax Compliance Certificate using the new KRA M-Service App, providing a quick and efficient way to verify compliance status.

Conclusion

In the world of taxation, the Tax Compliance Certificate serves as a symbol of commitment to financial responsibility. Whether for professional endeavors, business operations, or regulatory compliance, possessing a valid TCC is an essential aspect of navigating the fiscal landscape.

As the taxation landscape evolves, staying informed about the TCC application process and ensuring continuous tax compliance is key for individuals and businesses alike.