In a landmark move in 2018, the St. Regis Aspen Resort in Colorado embraced the digital revolution by tokenizing a portion of its real estate through Aspen Digital. With a minimum investment of $10,000 and a total offering of $18 million, this innovative approach to real estate investment was been facilitated by Templum Markets, an SEC-registered operator specializing in the initial offering and secondary trading of digital assets as securities.

The St. Regis Aspen Resort

The St. Regis Aspen Resort, nestled in the picturesque surroundings of Colorado, boasts 179 rooms and multiple food and beverage outlets. In a bid to modernize real estate investment and enhance liquidity, a portion of this esteemed resort has been tokenized, making it accessible to a broader range of investors.

Templum Markets and Regulation D Compliance

Templum Markets played a pivotal role in the successful tokenization process. As an SEC-registered operator, Templum Markets ensured compliance with Regulation D, offering and selling the tokenized securities exclusively to accredited investors through a private placement. This regulatory adherence provides a level of security and transparency crucial in the realm of digital asset securities.

Crowdfunding Support from Indiegogo

To facilitate marketing and outreach, the project received support from the crowdfunding platform Indiegogo. This strategic partnership expanded the project’s visibility and allowed a diverse pool of investors to participate in the tokenized real estate offering. The collaboration with Indiegogo exemplifies the synergy between traditional crowdfunding platforms and cutting-edge blockchain initiatives.

Distribution of Dividends and Secondary Trading

As part of the tokenized investment structure, dividends are planned to be distributed on-chain to token holders using Ether (ETH), adding a layer of transparency and efficiency to the dividend distribution process. Additionally, secondary trading of the tokenized securities is facilitated by Templum, exclusively to whitelisted investors. This secondary market introduces liquidity to the traditionally illiquid real estate market, providing investors with flexibility in managing their assets.

Blockchain-Powered Real Estate Investment Trust (REIT)

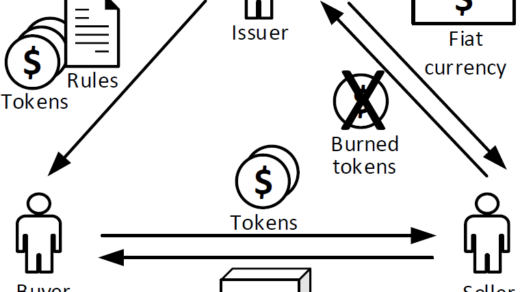

The tokenization of the resort involved the formation of a single Real Estate Investment Trust (REIT). Each Aspen Digital Token represents an indirect ownership interest in one deposited share of the common stock of the REIT. This blockchain-powered REIT structure, programmed with smart contracts, not only simplifies transactions but also introduces tax efficiency to the investment structure. The combination of blockchain technology and the REIT framework presents a forward-thinking solution to streamline real estate investment processes.

Conclusion:

The tokenization of the St. Regis Aspen Resort through Aspen Digital, supported by Templum Markets and Indiegogo, marks a significant advancement in the world of real estate investment. This innovative approach not only democratizes access to prestigious real estate projects but also enhances liquidity and transparency in the market. As blockchain technology continues to revolutionize traditional industries, the St. Regis Aspen tokenization project stands as a testament to the transformative power of digitizing real estate assets.