Egypt, a country with a rich history and a rapidly evolving economy, has witnessed a dynamic approach towards crypto asset regulation over the past few years. In this article, we delve into the evolving landscape of crypto asset regulation in Egypt and how the Egyptian government and financial authorities have responded to the challenges posed by digital assets.

The Initial Stance

Egypt’s journey with crypto assets began with caution. The Egyptian Banking Law No. 194 of 2020 clearly stipulated that the issuance or trade in crypto assets, as well as the operation of crypto asset platforms, were prohibited unless granted approval by the Central Bank of Egypt (CBE) in adherence to the forthcoming requirements.

However, at the time, these specific requirements had not been officially released. Violating these regulations could result in imprisonment and fines ranging from EGP 1 million to EGP 10 million. In essence, Egypt had taken a somewhat restrictive approach toward crypto asset activities.

Central Bank of Egypt’s Warning

Even before the formal legislation, the CBE issued a warning in 2018, highlighting the risks associated with crypto asset usage and advising Egyptian residents to refrain from engaging with digital assets. While not legally binding, this advisory served as an early indication of the government’s stance on crypto assets. Importantly, Egypt did not consider crypto assets as legal tender, and their use for everyday transactions by residents was not permitted.

The Religious Decree

Adding to the regulatory landscape, Egypt’s Dar al-Ifta, the primary Islamic legislator in the country, issued a religious decree in 2018 classifying commercial transactions in Bitcoin and other crypto assets as haram (prohibited under Islamic law). The Dar al-Ifta expressed concerns about the potential risks crypto assets posed to national security and financial systems, including their potential use in financing terrorism.

It is crucial to note that this fatwa is a religious decree rather than a legally binding law. Therefore, its impact on the average resident’s interaction with crypto assets is limited.

Shifting Attitudes

Surprisingly, Egypt’s stance on crypto assets evolved. In 2019, the CBE announced that it was working on a draft law to ban the creation, trading, or promotion of crypto assets without an appropriate license. This signaled a shift in the regulator’s approach toward digital assets, acknowledging the need for regulation rather than an outright ban.

Central Bank and Banking Sector Law No. 194 of 2020

In 2020, the Egyptian Parliament passed the Central Bank and Banking Sector Law No. 194. This legislation introduced several digital and technological mechanisms to facilitate the digital transformation of Egypt’s banking and financial sector. These mechanisms encompassed digital finance, digital settlement of cheques, E-Money, crypto assets, FinTech, and RegTech.

Additionally, the new law offered a framework for the establishment of ‘Digital Banks’ in Egypt. This indicated that the CBE was moving towards accommodating digital financial innovations while ensuring proper oversight.

Recent CBE Warnings

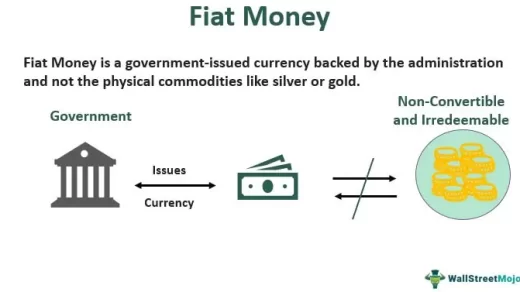

In response to illegal digital platforms that deceived Egyptian citizens, promising substantial returns through crypto asset investments, the CBE issued another warning. It warned citizens against participating in fraudulent activities related to crypto assets, stressing that no licenses had been issued for crypto asset trading in Egypt. The CBE cited the high risks, including price volatility, financial crimes, and electronic piracy, associated with crypto assets. It also emphasized that crypto assets lacked central bank backing and accountability.

Conclusion

The Egyptian crypto asset regulatory landscape is evolving, transitioning from a restrictive approach to one that acknowledges the potential benefits of digital assets. While Egypt has not yet embraced crypto assets as a legal form of payment, its efforts to establish a regulatory framework indicate a growing acceptance of digital innovation in the financial sector. Egypt’s approach to crypto asset regulation reflects its desire to balance innovation with risk mitigation while keeping an eye on national security and financial stability.